Japan e-commerce market to grow by 10.5% in 2021

The Japanese e-commerce market is estimated to register a strong growth of 10.5% in 2021, as consumers are increasingly shifting from offline to online, according to GlobalData, a leading data and analytics company.

Japan has a well-developed e-commerce market and has registered sustainable growth over the last five years supported by high mobile and online penetration and high consumer preference for online transactions. Consumers are increasingly shifting from in-store to online purchases, with e-commerce being one of the few areas that has shown positive impact from the pandemic.

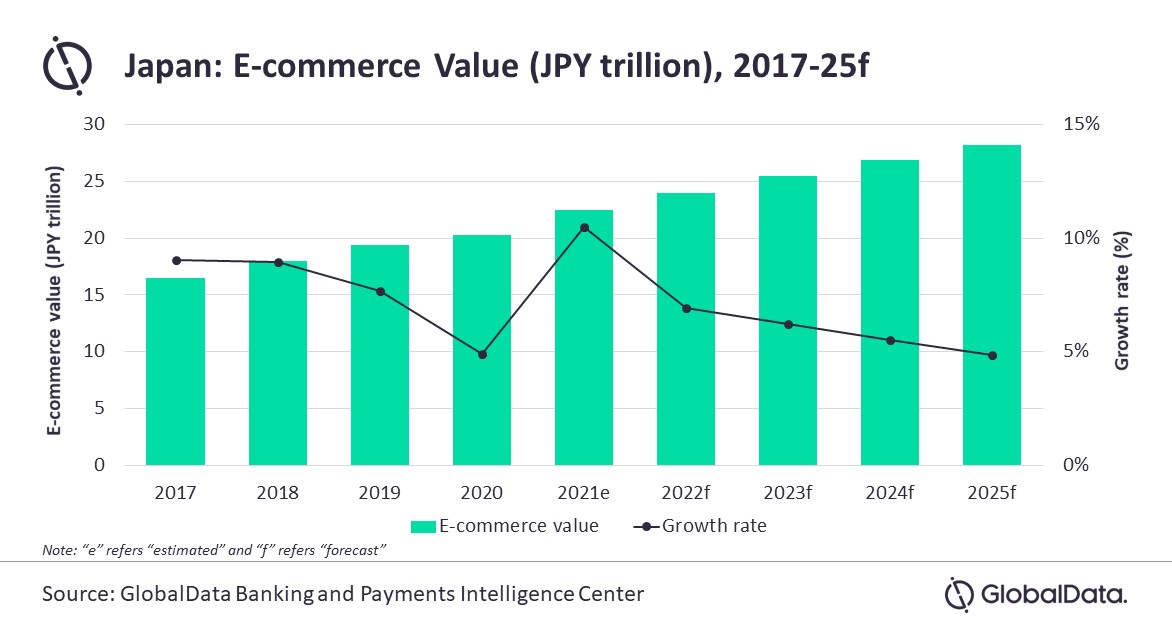

An analysis of GlobalData’s E-Commerce Analytics reveals that e-commerce sales in Japan are estimated to reach JPY22.4 trillion (US$217.5bn) in 2021. E-commerce sales are expected to rise further at compound annual growth rate (CAGR) of 5.9% between 2021 and 2025, to reach JPY28.2 trillion (US$273.4bn) in 2025.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “The pandemic has pushed e-commerce activities in the country, as concerned consumers are increasingly using online channel for their purchases to avoid getting exposed to disease vectors. With social distancing rules in place and closure of several brick and mortar stores, shoppers had to embrace online channel even for day-to-day shopping.”

According to the ‘Survey of Household Economy’ conducted by the Ministry of Internal Affairs and Communications, over 50% of households (with two or more members) ordered goods and services over Internet in July 2021. In addition, the average monthly expenditure on online shopping per household in July 2021 was up by 11.5% compared to monthly average of 2020.

According to GlobalData’s 2021 Financial Services Consumer Survey*, payment cards are the most preferred payment method for e-commerce purchases in Japan, accounting for 64.2% share in 2021.

Meanwhile, alternative payment solutions such as PayPay, Amazon Pay, Apple Pay and Google Pay are increasingly being used for online payments, with PayPay accounting for 4.9% share followed by Amazon Pay (3.8%).

Mr Sharma concludes: “The COVID-19 pandemic has brought in a permanent shift in consumer buying behavior pushing them towards online, a trend that is expected to continue even beyond the pandemic times.”