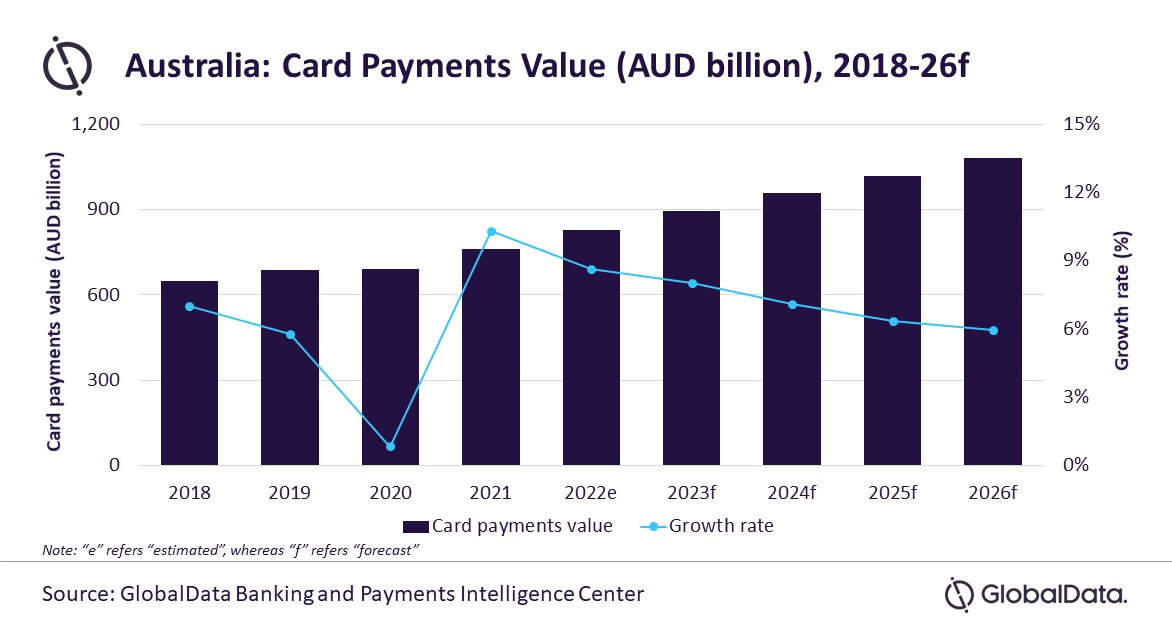

Card payments in Australia to grow by 8.6% in 2022

The Australian payment card market, which was affected by COVID-19, is now on the path of recovery and is expected to grow by 8.6% in 2022, supported by improved economic conditions and revival in tourism, forecasts GlobalData, a leading data and analytics company.

Like most markets globally, Australia was also affected by the COVID-19 pandemic. Reduced consumer spending, stringent lockdown and travel restrictions had affected card payments market, registering a subbed growth of 0.8% in 2020.

GlobalData’s Payment Cards Analytics reveals that the gradual recovery in economy helped the market to rebound with 10.3% in 2021. With the economy now returning to normalcy, card payments are anticipated to increase further at a CAGR of 6.9% between 2022 to 2026, to reach AUD1.1 trillion (US$785.2bn) in 2026.

Nikhil Reddy, Payments Senior Analyst at GlobalData, comments: “Australia has a well-developed card payment market with strong payment infrastructure and high consumer preference for electronic payments. The market growth plummeted during the pandemic due to reduced card spending in sectors like travel and accommodation. However, with rise in consumer spending and travel restrictions being lifted, strong growth in card payment could be seen.”

Australia was among the few countries which implemented stringent COVID-19 measures to control the outbreak. As part of this, the country barred its citizens from traveling outside the country for almost 18 months. The restrictions were lifted on 1 November 2021, allowing fully vaccinated citizens and permanent residents to freely travel to and from Australia.

Furthermore, the government also opened its borders to international travelers from 21 February 2022. This will further push economic activities and positively contribute to consumer spending and support card payments growth.

The government has been taking various measures to push card payments in the country. The Cashless Debit Card program, which is available across various parts of the country, was expanded to the Cape York region of Queensland and across the Northern Territory in March 2021.

Under this program, 80% of the social welfare payments are transferred to special purpose restricted bank account. The amount can be accessed via linked debit card, which can only be used for merchant payments but not for ATM cash withdrawals.

Reddy concludes: “Australians are prolific users of payment cards, with high degree of usage supported by its well-developed payment infrastructure. The card payment market has quickly recovered from COVID-19 slowdown, supported by economic recovery, rise in consumer spending, and revival in travel sector.”