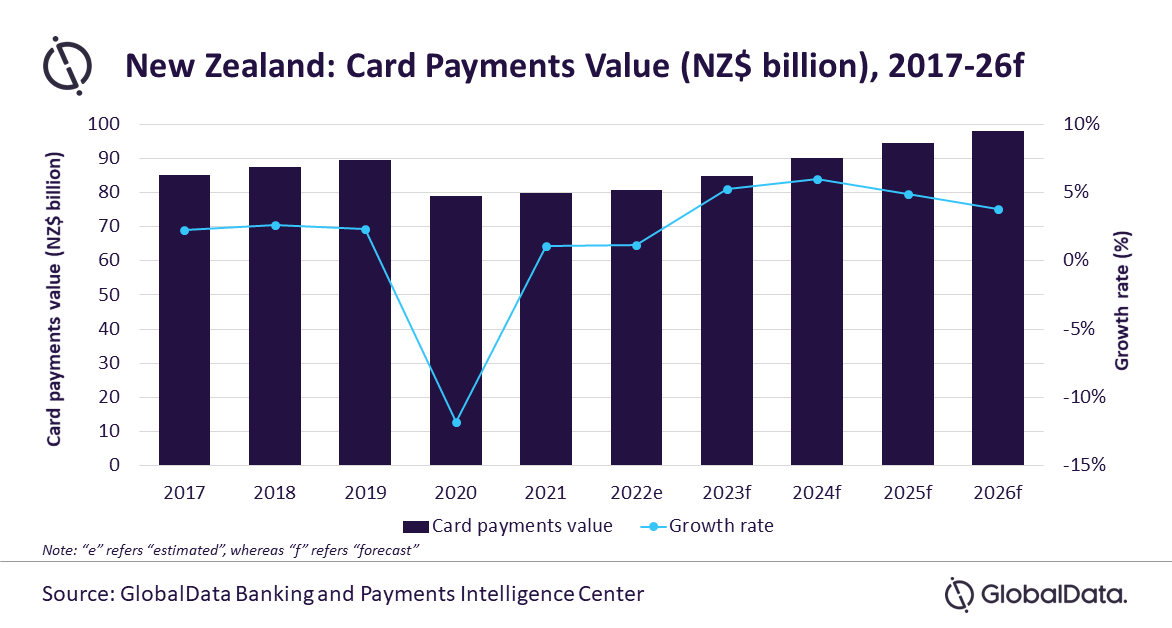

Card payments in New Zealand to grow at 5% CAGR between 2022 and 2026

The New Zealand payment card market is expected to gradually recover from the COVID-19 pandemic to register a compound annual growth rate (CAGR) of 5.0% between 2022 and 2026 and reach NZ$98.0 billion ($67.1 billion) in 2026, forecasts GlobalData, a leading data and analytics company.

According to GlobalData’s Payment Cards Analytics, the value of card payments registered a decline of 11.8% in 2020 due to the COVID-19 pandemic. With the opening of businesses, card payments market registered a slow growth of 1.1% in 2021 to reach NZ$79.7 billion ($54.6 billion).

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “The payment card market in New Zealand is mature, with each individual holding over three cards with high frequency of card payments at 91.4 in 2021. Persistent efforts from the country’s financial authorities and banks to increase the awareness of electronic payments and develop payment acceptance infrastructure have been successful in encouraging the consumers to use card payment methods for day-to-day transactions.

“Besides cards, the rising preference for contactless payments have further resulted in the increased preference for cashless methods of payment. Although the COVID-19 pandemic affected the consumer spending, it also highlighted the importance of non-cash payment methods, thus further driving the use of electronic payments in the country.”

There has also been a significant change in consumer payment habits post pandemic as large number of consumers are moving away from CASH PAYMENT, and instead opting for digital payment. The value of ATM cash withdrawals has reduced by 20.9% and 5.9% in 2020 and 2021, respectively, a trend that is expected to continue in 2022.

According to Payments NZ, a governance organization which manages payment and clearing systems in the nation, contactless payments are gaining popularity among consumers, with a 62% rise in contactless card transactions between 2018 and 2020. The share of contactless payments in total card payments increased from 24% in 2018 to 39% in 2020.

Sharma concludes: “The gradual rise in consumer spending along with the rising preference for digital payments will help the country’s card market growth. However, growth could be slower in the near future due to the heightened global economic uncertainty and higher inflation, dampening consumer confidence.”