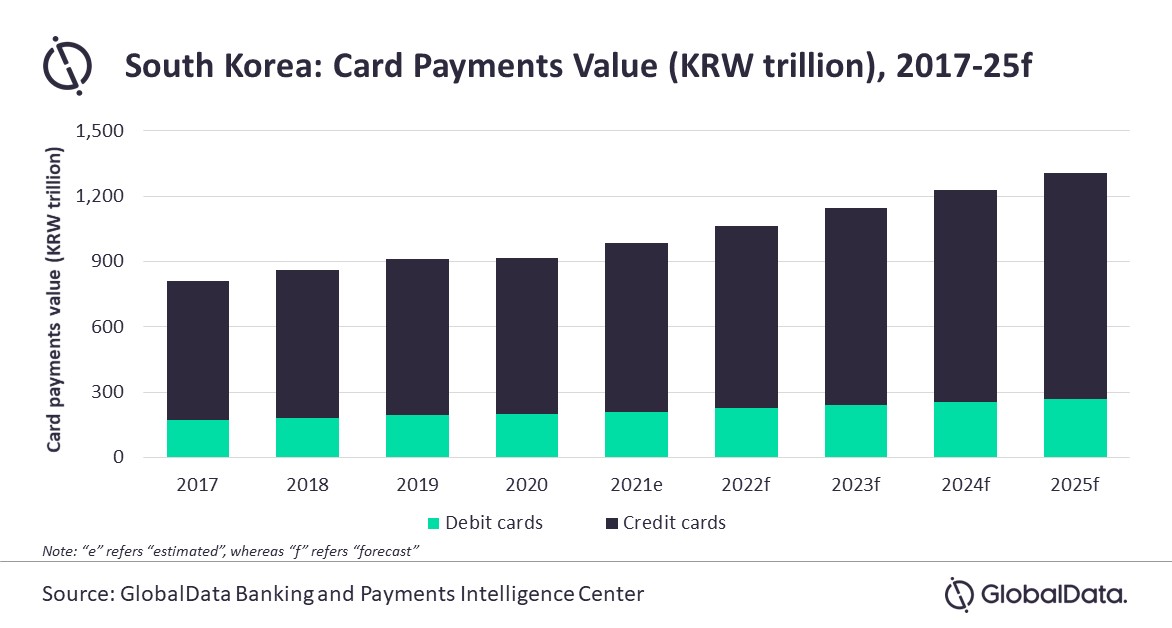

Card payments in South Korea to reach US$1.2 trillion in 2025

South Korea’s payment cards market is well developed and has been on a sustained growth for the past few years. High banked population, developed payment infrastructure and high financial awareness has resulted in high card penetration and usage. Against this backdrop, the card payments market is set to increase at a compound annual growth rate (CAGR) of 7.4% to reach KRW1,307.7 trillion (US$1.2 trillion) in 2025, says GlobalData, a leading data and analytics company.

According to GlobalData’s Payment Cards Analytics, card payments value in South Korea is estimated to increase by 7.3% in 2021 to be valued at KRW983.2 trillion (US$903.3bn).

South Korea is among few nations which affectively handled the COVID-19 pandemic compared to other developed markets such as the US and the UK. Although a complete lockdown was not implemented, through comprehensive testing, quarantine, and treatment, the country successfully flattened the curve.

Nikhil Reddy, Payments Senior Analyst at GlobalData, comments: “South Korea’s payment card market is highly developed backed by a strong banked population and high financial awareness. Koreans have a high usage of payment cards with average frequency of credit card usage at 125.8 times in 2021 – much higher than even developed markets like France, Canada, the US, and the UK.”

Banks incentivize card payments through a range of benefits including cashback and discounts. Further government measures to boost electronic payments and tax incentives associated with payment cards supported its growth.

Credit card is the preferred card type in South Korea, accounting for 78.7% of card payments value in 2021. The high preference for credit cards is primarily due to reward benefits such as discounts and cashback they offer.

The government is taking various measures to push card payments. In January 2021, the government announced new tax benefits on credit card spending, allowing customers to claim additional tax deduction up to KRW1.0m (US$918.81) on taxable income if they increase credit card spending by 5% in 2021 compared to previous year. On similar lines, the government launched a subsidy scheme in June 2021 allowing credit card holders to receive cashback on credit card spending in the form of points.

Mr Reddy concludes: “While the COVID-19 pandemic has affected the growth of card payments in the short-run, it will grow at a robust pace over the next four years, supported by the economic recovery and government incentives.”