Credit card balances outstanding in Singapore to grow by 4% in 2023

As Singaporeans regain confidence in their financial stability and embrace a new normal post COVID-19 pandemic, the credit card market is primed to flourish. Against the backdrop, the credit card balance outstanding is expected to grow by 4% to reach SGD13.7 billion ($10.2 billion) in 2023, forecasts GlobalData, a leading data and analytics company.

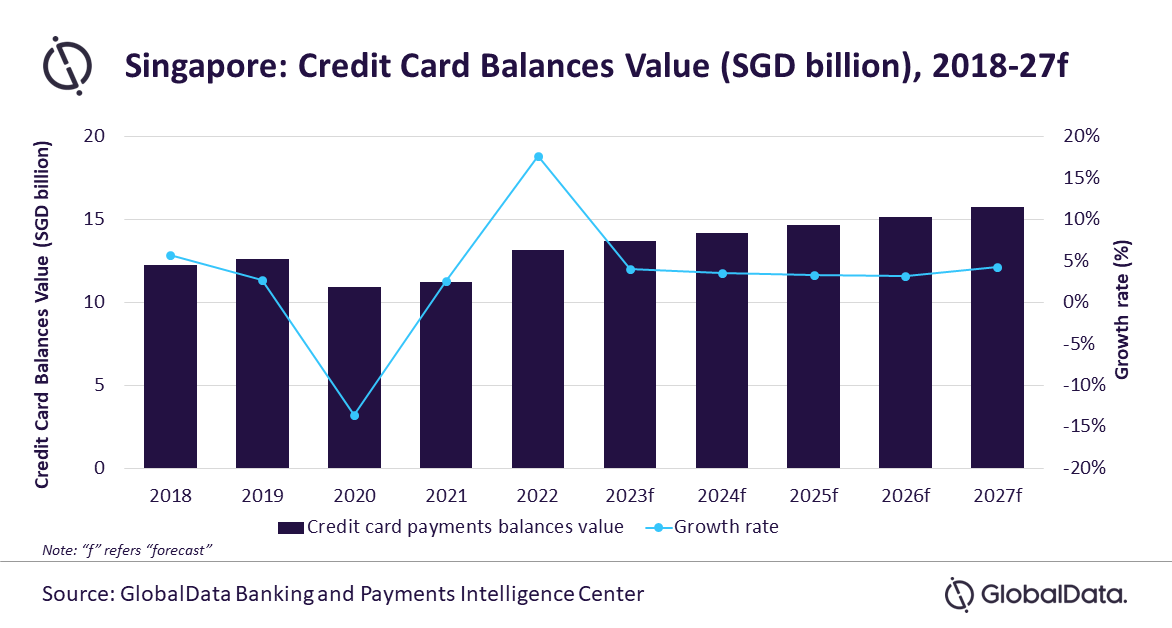

The economic uncertainty caused by the pandemic forced consumers to cut down on unnecessary spending thereby adversely affected the credit card market. GlobalData’s Global Retail Banking Analytics reveals that credit card balances outstanding registered a sharp decline of 13.5% in 2020. However, with the revival of economic activities, credit card market recovered with balances outstanding growing by 2.6% in 2021 and 17.6% in 2022.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Singaporeans are frequent users of credit cards, with the average frequency of card payments per person at 131.2 in 2022, up from 99.7 during pre-pandemic period in 2019. The country’s strong payment infrastructure, high consumer preference for card payments, and merchant acceptance have supported this growth. The pandemic also accelerated the shift in consumer preferences towards non-cash methods of payment, which also led to an increase in credit and charge usage and balances.”

Singaporeans prefer credit cards for payments, mainly due to value-added services such as reward points, discounts on purchases at partner retailers, instalment facilities, and other benefits.

Strong card acceptance network in the country also encourages higher credit card usage. Singapore has over 62,000 point of sale (POS) terminals for every million individuals, which is much higher compared to its peers, including Australia, New Zealand, China, Hong Kong, Japan, and Taiwan.

Rising e-commerce payments is also contributing to growth in credit and charge card usage in Singapore. According to GlobalData’s 2022 Financial Services Consumer Survey*, credit and charge cards are one of the most preferred payment methods for online payments with 29.4% share in 2022.

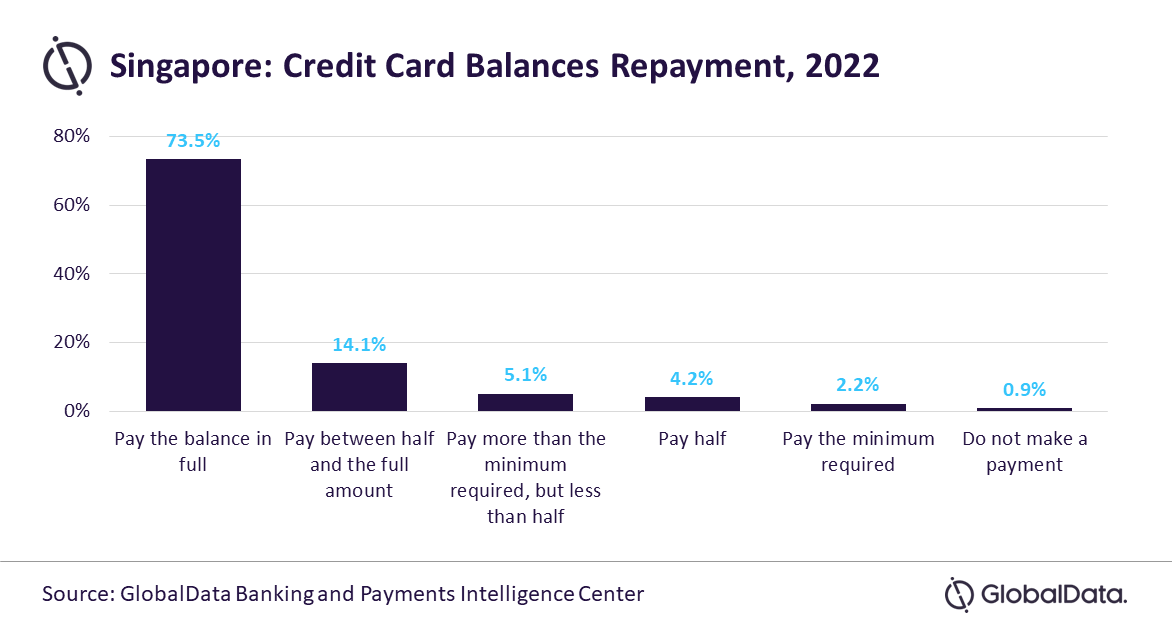

In terms of repayment of balances, 73.5% of consumers paid their monthly credit card balances in full in 2022, which is lower compared to 82% reported in 2020, according to the survey. This implies that Singaporeans are gradually becoming comfortable taking on debt and carrying the balances. The availability of flexible payment options offered by most banks and merchants in the form of instalment payment on credit cards are helping this trend, which is also contributing to the overall growth in credit card balance outstanding.

Sharma concludes: “The economic recovery and rise in consumer spending will continue to push credit card usage in Singapore, which will further drive the overall credit card balances. The credit card balances outstanding is expected to grow at a compound annual growth rate (CAGR) of 3.7% between 2022 and 2027 to reach SGD15.8 billion ($11.8 billion) in 2027.”

*GlobalData’s 2022 Financial Services Consumer Survey was carried out in Q2 2022. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries