The Global Entrepreneurship Monitor (GEM), in its essence, is a research programme developed jointly between the London Business School and Babson College in the USA in 1997. The programme monitors economic development of a country through studying entrepreneurial activity and specifically the characteristics of new and small businesses. The GEM methodology emphasizes the importance of small businesses in contributing to economic development and provides deeper insight into these building blocks of an economy, in particular for lesser developed economies. The GEM method of study contrasts with the traditional approach that focuses on exploring macro-level data and contributions of large corporations in economic development.

GEM Report

The GEM methodology entails two surveys: the Adult Population Survey (APS); and the National APS surveys those adults who fall under the Total Early- Stage Entrepreneurial Activity rate (TEA)2 category. It captures entrepreneurial activity and perceptions within a country.

The NES, on the other hand, analyses the entrepreneurship environment. Additional information is gathered from local and international sources. These sources are used to understand the relationship between entrepreneurial activity and their economic impact, perceptions on entrepreneurship, and identify factors that encourage or hinder this activity.

Countries, and since the 2008 report, have been classified into one of three phases based on GDP per capita and the share of exports of primary goods. First: factor driven countries. Their economy is characterised by unskilled labour and a dominance of agriculture and development efforts are concentrated in establishing solid economic foundations. Second: efficiency driven. This phase entails higher skilled workers, industrialisation, growing company size, and capital intensive technologies become more dominant in large organisations. Finally: innovation driven countries. Entrepreneurship and innovation dominate yet they depend on an existing solid foundation which provides basic requirements. Here, enterprises are knowledge driven and the services sector expands.

The TEA rate

The main indicator used in the GEM is TEA rate. The general trend for the TEA is that it is higher for comparatively less developed economies; it is higher in countries with low GDP per capita where necessity driven entrepreneurship is also relatively higher. Business discontinuance is a corresponding indicator for the TEA where high TEA rates are generally accompanied by high discontinuance rates which can indicate many aspects of the entrepreneurial environment such as education, laws, support, etc.

More Indicators

Other key indicators are:

perceptions about the availability of good opportunities for starting a business in the next six months (Perceived opportunities);

perceptions of having the necessary skills and knowledge (Perceived capabilities);

fear of failure; entrepreneurial intentions; beliefs about entrepreneurship (Entrepreneurship as a good career);

high status to successful entrepreneurs; Media attention for entrepreneurship.

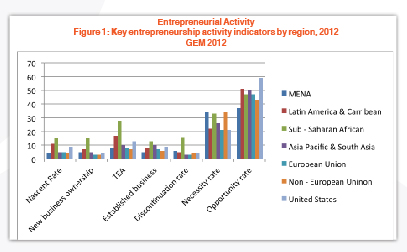

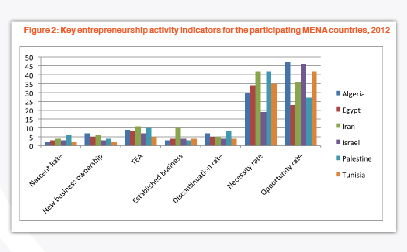

The two figures (1&2) depict these key indicators of entrepreneurial activity and by perceptions of the regions studied in GEM 2012.

THE MENA Region

The main GEM indicator, TEA rate, was highest for the participating Sub-Saharan African countries at an unweighted average of 28%, and the second highest was for the Latin American and Caribbean countries at 17%. This is expected as TEA rates tend to be higher in countries with low GDP per capita and with a high share for necessity driven entrepreneurship. The MENA region is fourth highest at a rate of 8%, as is also the European Union. Iran is the highest in these participating MENA countries at a rate of 11%, and second is Palestine at 10%.

Entrepreneurial motivations differ among these regions as well. Push and pull factors within the entrepreneurial environment weigh in on entrepreneurial activity decisions. This is captured by the necessity rate which is calculated as a percentage of the TEA rate from the APS. The MENA region has the highest necessity rate at 34%, as also do the non-European Union European countries such as Turkey.

This high necessity rate in the MENA region goes hand-in-hand with the high unemployment rates as people are pushed into entrepreneurship as the only means to earn an income due to lack of employment opportunities. The highest necessity rates are for Iran and Palestine, both at 42%. This is distinguished from the opportunity rate which captures those seeking entrepreneurship activity to pursue independence or higher incomes. This is usually highest in innovation driven economies such as that of the United States. Algeria and Israel enjoy the highest opportunity rates and are at 47% and 46%, respectively, and the third highest in the MENA region is Tunisia. It is noteworthy to mention that Israel and Tunisia enjoy economic development beyond the factor driven stage, hence, higher incomes, higher education, and supportive economic and social settings for entrepreneurship.

business discontinuance rate

Another key indicator is the business discontinuance rate. The main reasons across the regions for discontinuing a business are lack of financing opportunities and the business not being profitable. The region with the highest business discontinuance rate was Sub-Saharan Africa, and second was the MENA region. This indicator is generally higher in factor driven economies but declines with economic development. Palestine had the highest discontinuation rate among MENA countries at a rate of 8%, and second came Algeria at 7%. Tunisia was 4%.

The following figure provides a breakdown of key indicators of entrepreneurial activity for the MENA region.

Entrepreneurial Attitudes

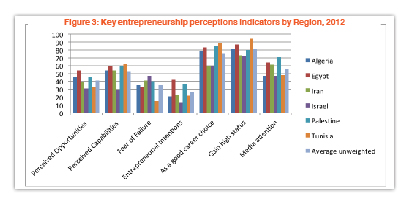

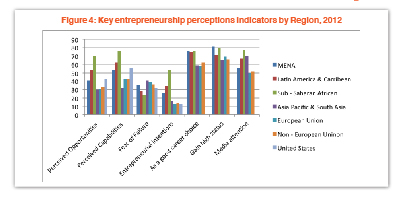

The first step in engaging in entrepreneurial activity can be a perception of good opportunities for establishing a business. This can be encouraged by a belief that they hold the necessary skills and knowledge for such activities. As for entrepreneurial perceptions, the following figure, Figure 3, captures entrepreneurial attitudes as perceived by the surveyed persons in the APS.

A good indicator about the presence of good entrepreneurial potential and opportunity for starting a business in the next 6 months is the Perceived Opportunities indicator. These entrepreneurs who believe that there are such opportunities are more likely to believe they enjoy the skills and knowledge to found a business.

Sub – Saharan African countries enjoyed the highest perceived opportunity rates at 70%. This means that 70% of respondents believe there are good opportunities to establish a business. Of these respondents, 76% believe they have the needed skills and knowledge to embark on an entrepreneurial activity. MENA region counties ranked third at 41%. The second rank was for Latin America & Caribbean countries.

Within the MENA region, Egypt ranked first where 54% of respondents perceived good opportunities to be taken advantage of for entrepreneurial activities. Algeria and Palestine both ranked second at 46%. While Tunisia and Israel ranked last at 33% and 31%, respectively. This is not surprising as countries with greater development levels tend to score lower on this indicator.

Another related indicator is the Entrepreneurial Intentions indicator. Although respondents might see potential opportunities for activity, they might not be inclined to participate in entrepreneurship. The inclination decreases with greater economic development as can be seen across countries of different development levels, as well as in MENA region countries. As an example: 30% of respondents in Asia Pacific and South Asia perceived good opportunities yet only 17% indicated entrepreneurial intentions. This can be seen as well within the MENA countries where 41% of respondents perceived good opportunities while only 26% are inclined towards entrepreneurship.

More specifically on the differences within MENA countries, Israel and Algeria show the greatest discrepancies between perception of good opportunities and intentions to enter into an entrepreneurial activity. In Israel, 31% of respondents perceived good opportunities while only 13% indicated an intention to enter into an activity. Also, in Algeria, 46% of respondents perceived good opportunities, yet only 21% showed intention to enter into an entrepreneurial activity.

Palestine Entrepreneurship Monitor 2012

This section focuses on the third Palestinian participation in the GEM report where survey results are discussed, pull and push factors specific for entrepreneurial activity in Palestine, and recommendations to assuage the existing hindrances, where possible. The Palestine Entrepreneurship Monitor is conducted as part of the Global Entrepreneurship Monitor (GEM). Through funding from the International Development Research Center (IDRC), Palestine has been participating in the GEM since 2009. It is conducted on a biannual basis as the data witnesses few or only changes on an annual basis.

Entrepreneurship is a critical component of the Palestinian economy and a driving force for economic development. Its importance stems from the fact that about 97% of enterprises are of Micro, Small and Medium Enterprise (MSME) scale, employing less than 10 employees. Further, 90% of all MSMEs are considered small enterprises that employ fewer than 5 employees whereas larger sized enterprises, those with 20 or more employees, employ about 1% of all workers.

Study of entrepreneurship is critical for assuaging the high unemployment that exists especially among the youth population. The strong link between entrepreneurship and employment on the one hand, and the large youth population on the other, puts youth entrepreneurship in the spotlight. Hence, that was the special topic for the GEM 2012. Those aged 25 – 29 years of age make up nearly 30% of the population. A considerable number in economic and social terms, which becomes even more alarming when the performance and composition of the economy are taken into account.

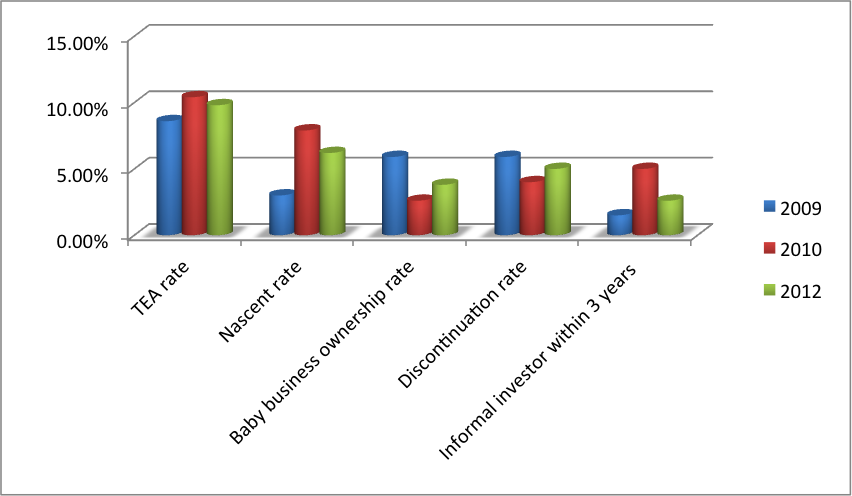

As for key entrepreneurial indicators in Palestine, the TEA rate decreased in 2012 to 9.8% from 10.4% in 2010. Another key indicator is the Business discontinuation rate which increased to 5% in 2012 from its 4% level in 2010. These and other entrepreneurial measures are shown in figure 3, entitled ‘Entrepreneurial activity measures’.

Entrepreneurial activity is a complex process where culture and social contexts seem to have a strong effect. Overall, outlook for entrepreneurial activity was perceived as ‘gloomy’ by the surveyed adults, where only 46% view good entrepreneurship opportunities in the next six months. This is a decrease from its 2009 level of 52% and is among the lowest rates in factor driven economies. It is worth noting that necessity based entrepreneurial activities neared 70%; an indication that entrepreneurs seek to secure employment for lack of employment opportunity.

The overall findings in Palestine, when comparing the 2010 GEM report with that of 2012, is a negative trend for most indicators; in particular TEA rate, entrepreneur gender gap, and business discontinuation rates. Discontinuation was attributed to lack of profitability and difficulty in obtaining finance. Half the young early stage entrepreneurs were driven by necessity. Furthermore, the NES found the main three constraining factors for entrepreneurship to be: the political, institutional and social context; financial support; and government policies. Accordingly, GEM 2012 lays out recommendations aimed at policy makers in order to promote entrepreneurship, especially amongst the youth. The key recommendations are: to alleviate impediments created by the political instability and risks; to address business discontinuation through creating programmes that assist in studying project feasibility and conducting workshops and seminars to strengthen entrepreneurs’ business skills; to create business outreach centres to facilitate networking; to strengthen the primary and secondary education systems in entrepreneurial topics; to expand Technical Vocational Education and Training (TVET); and to increase the role of the PA in supporting young entrepreneurs through workshops and capacity building.

There ought to be at least as many ways – and as strong an effort – to promote Palestinian entrepreneurship as there are impediments; the prime of these efforts ought to be thorough objective analyses of the main building blocks of the economy, i.e. entrepreneurial activity. Study of entrepreneurship provides the needed insight for an unrelenting enhancement of this economic block of activity and livelihood. It also hands policy makers options from which they can extract the most suitable priority-based policy frameworks that best meet the Palestinian demands. GEM is a unique and necessary tool which clarifies many aspects and characteristics of entrepreneurship in Palestine and has been proving essential.