Middle East and North Africa, Trade and Investment Report

by The American Chambers MENA Regional Council

Middle East North Afrrica (MENA) Business Environment

While the last two years may have been marked by ongoing political stalemate and regional and local unrest, the Arab MENA region managed to overcome negative pressures and produce solid overall growth.

The growth split in the Arab MENA region has widened even more in 2012 with a clear distinction between oil exporters and importers. While growth prospects have improved to 6.6% in 2012 (up from 4.8% in the April 2012 forecast), the prospects for oil importers have substantially declined to 1.2% in 2012 (down from 2.2% in the April 2012 forecast). Stronger MENA growth in 2012 was mainly on account of accelerated growth among oil exporters and as a result of a strong rebound of activity in Libya since late 2011.Higher oil prices and increased government spending have been the key differentiating factors that have brightened the growth prospects for oil exporting countries. Internal conflicts and their aftermath remain a source of uncertainty, and have led to steep declines in tourism and FDI for oil-importing countries. At the same time, slowing growth in the EU and the US – major trading partners for most economies in this group – has also constrained their growth.

The Arab MENA business environment has had a lot to deal with since the beginning of the Arab Spring in January 2011. Governments have been struggling to adjust to important shifts in the political landscape while securing economic and social stability through more inclusive medium-term growth.

This has slowed down specific reform efforts to improve business regulation. Although economies of the region have made some strides in reducing the complexity and cost of regulatory processes, there is concern over weak investor and property rights protection. With an average regional ranking of 98% out of 138 countries worldwide (ranked), there is still much room for improvement.

In the World Bank Doing Business Report for 2013, the UAE and Bahrain scored top of the region for doing business in general. Morocco was the biggest improver in the World Bank’s 2012 rankings, leaping more than 20 places from 115 in 2011.

Nearly 30% of companies in the MENA region perceive business licensing and permits as a major constraint to their activities, by far the highest share among the world’s regions, though the share is substantially lower in Egypt and Morocco.

The labour market and education reforms are also critical areas in need of reform. As more of the young population enters the labour market there is a need to ensure adequate skill-building and worker protection.

MENA-US Trade and Investment Trends

Most Arab MENA countries have extended their regional trade network towards the west through partnerships and bilateral agreements with Europe and US.

Over the recent years the US has been intensifying efforts to increase bilateral trade, expand investment and job creation, and to improve Arab MENA integration and trade facilitation. US trade with the Arab MENA region represented 4.1% of US exports and 5% of its imports during Jan-Oct 2012.

As such, the combined strength of the Arab MENA would rank it as the fifth largest trading partner with the US, capturing 4.65% of the USD 3.2 trillion total US global trade during this period.

MENA-US Trade

The amount of trade between the US and the Arab MENA has generally been on the rise since the beginning of the decade and up through 2012. Arab MENA exports to the US grew by a compound annual growth rate (CAGR) of 11.5% to reach USD 99.4 billion in 2011, while imports during the same period grew by 14.5% reaching USD 55.7 billion in 2011.

Saudi Arabia is the largest Arab MENA exporter to the US and the second largest importer. The UAE is the largest importer receiving almost 35% of US exports to the Arab MENA world. ( Middle East and North Africa-US trade and Investment Report)

Obstacles to Development in Middle East and North Africa

Numerous explanations have been put forward to explain why economic development in the MENA region has lagged behind other regions.

For example, it has been argued that:

- Weak integration in the global economy has prevented the region from reaping the opportunities of globalisation;

- “Easy money” from natural resources in some MENA countries has provided few incentives to develop sound economic policies or other productive industries, with the benefits of natural resources going to a few and not the public at large;

- Non-democratic political institutions have stifled innovation and economic competition, leading to slow growth and distortions in the economy;

- A weak business environment, stemming from heavy government involvement in the economy, red tape, corruption, and weak rule of law has deterred foreign investment;

- A weak educational system has not equipped youth in the region with the skills demanded by the private sector in a competitive global environment;

- Subsidies and lack of government infrastructure spending, with large portions of the budget going to defence and subsidies for basic needs, creates distortions in the economy; and

- Women constitute a low proportion of the labour force, preventing the region from tapping all its productive potential.

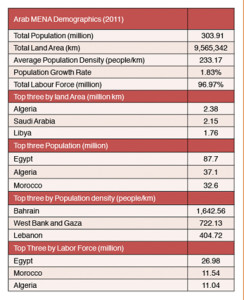

Arab MENA covers an area of 9.6 million square km, or 6.5% of the world’s landmass, which makes it the third largest after Russia and Canada. It is larger in area than China and the USA, and more than twice the size of the EU.

The population of Arab MENA comprises 4.3% of the total world population and is equivalent to almost one quarter of Chinas population, and just larger than the US’ population.