Chris Dinga, Payments Analyst at GlobalData, a leading data and analytics company, offers his view:

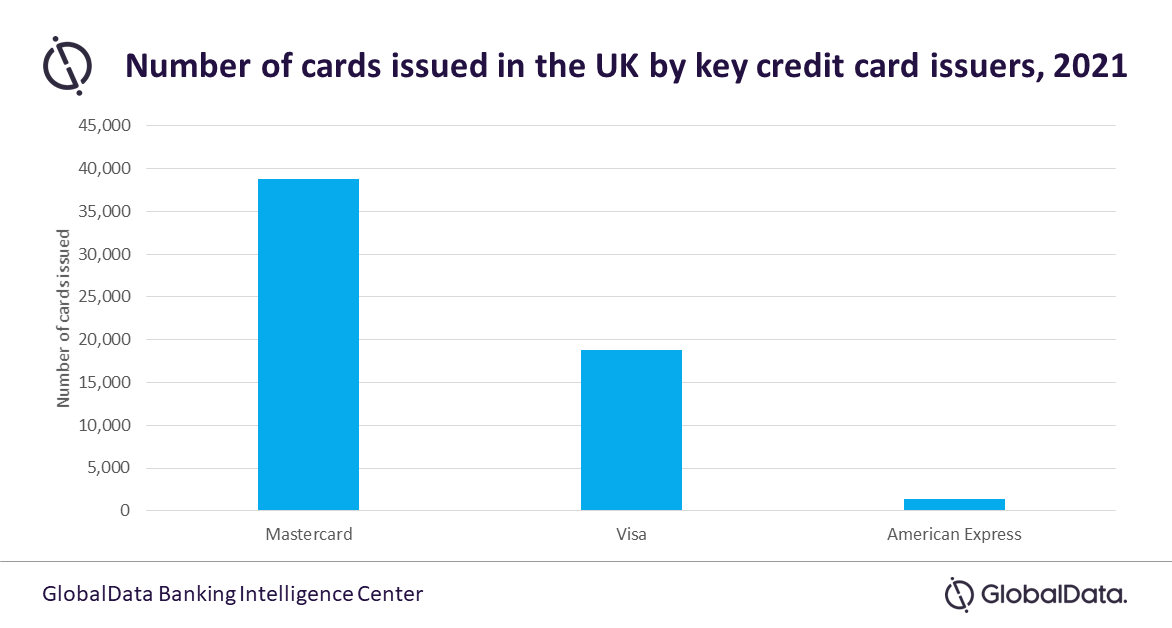

“Visa holds the second largest credit cards market share in the UK, with close to 20 million cards issued in 2021 – behind Mastercard with around 38 million, according to GlobalData. With both looking to increase fees since Brexit took away their 0.3% cap for online cross-border transactions, Amazon’s decision to only ban one of these companies seems odd – until you remember that Mastercard is Amazon’s credit card issuing partner.

“This represents a unique opportunity for both Amazon and Mastercard, as they can take advantage of the situation to promote the Amazon credit card to customers. UK-issued Visa credit card customers will have to either transfer to their debit card or find a new credit card provider if they want to remain an Amazon customer.

“Amazon’s interference will now mean a significant loss of revenue for Visa in the UK. Further, if the issue of interchange fees isn’t addressed, there will be ongoing issue for retailers, which will see their profit margins squeezed. Amazon is a dominant online retailer who is capable of banning Visa credit cards without risking to loss many customers as they are very dependent on Amazon. Smaller retailers may find it harder to do the same if they try to ban Visa credit cards.

“Credit cards are still dominant players for non-cash transactions, but they need to be aware of the growing competition that buy now, pay later (BNPL) providers and alternative payments such as Venmo represent. BNPL is gradually being adopted by retailers as they see higher conversion and growth opportunity by providing it to their customers. High interchange fees could accelerate the adoption of BNPL services by retailers.”