2026: An Economy on Edge

The global economy demonstrated greater resilience in 2025 than many had anticipated, despite formidable headwinds ranging from renewed trade tensions under Donald Trump’s policies to heightened geopolitical strains and ongoing conflicts in Ukraine and the Middle East.

As the new year begins, cautious optimism prevails that the most severe phase of the recent inflation shock is behind us, supported by interest rate reductions from the world’s leading central banks. Nevertheless, the ultra-low borrowing costs that characterised the pre-pandemic era are firmly in the past. Global economic growth is decelerating, and underlying conditions remain fragile.

Five key trends are shaping the economic outlook for 2026.

Artificial intelligence and the growth debate

After years of intense speculation, artificial intelligence is expected to play a central role in the global economy in 2026. The critical question is whether massive corporate investment in data centres, information technology, and automation will translate into sustained productivity gains, or whether enthusiasm will fade amid growing investor concerns over an asset bubble in US equity markets driven by exceptionally high valuations of AI-focused firms.

A survey conducted by Deutsche Bank among its institutional clients ranked the bursting of a technology bubble as the most significant risk for the year ahead, with 57% of respondents placing it among their top three concerns. Jim Reid, the bank’s global head of macro research, noted that no other risk has entered a new year with such a dominant profile, underscoring its centrality to the 2026 outlook.

Despite the potential upside from AI adoption, global GDP growth is expected to moderate in 2026, weighed down by the adverse impact of tariff policies on international trade. Consumer demand remains constrained after years of elevated inflation and high borrowing costs.

China’s growth trajectory is forecast to slow as policymakers in Beijing face increasing difficulty in stimulating economic activity. Meanwhile, the United States is expected to lead growth among the G7 economies, followed by Canada and the United Kingdom.

Easing inflation, persistent risks

Households across advanced economies have endured a prolonged cost-of-living squeeze as inflation remained elevated. Economists now anticipate a meaningful deceleration in consumer price growth in 2026, paving the way for a broader normalisation of inflation across developed markets.

This shift could allow central banks to conclude their cycle of interest rate cuts, effectively easing the drag imposed on economic activity by higher borrowing costs. In the United States, attention will focus on the Federal Reserve as the term of Chair Jerome Powell concludes in May. Markets will closely monitor whether his successor pursues deeper rate cuts, particularly amid political pressure from Donald Trump. Concerns over potential political interference are expected to continue weighing on investor confidence

The United Kingdom risks lagging behind its peers in the disinflation process. The International Monetary Fund previously forecast that the UK would experience the highest inflation rate in the G7, although this assessment predated Chancellor Rachel Reeves’s budget. The Bank of England now expects fiscal measures to bring headline inflation closer to its 2% target by the summer.

For the European Central Bank, inflation across the euro area is already hovering near its target, reducing the likelihood of further policy action in 2026. Nonetheless, economists caution that inflationary pressures could re-emerge, limiting the scope for additional rate cuts.

As Jack Meaning, chief UK economist at Barclays, observed, the global economy remains vulnerable to fresh shocks. However, absent major disruptions, inflation dynamics are increasingly characterised by marginal deviations from target rather than the sharp swings seen in recent years, marking a return to a more familiar economic environment.

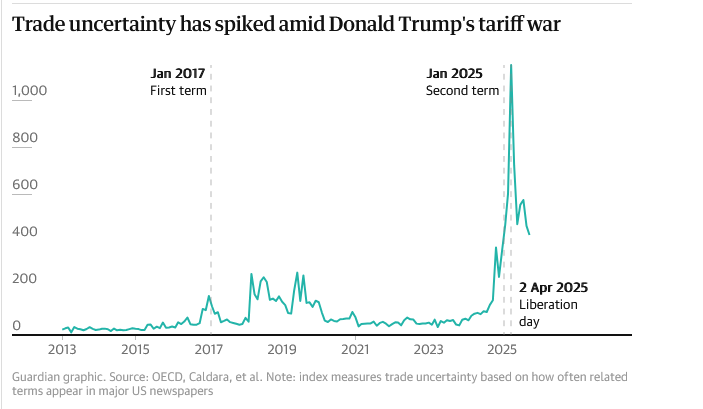

Managing elevated trade tensions

While the initial shock of Trump’s “liberation day” tariff announcement last April has faded, trade policy uncertainty remains elevated. US tariff levels are significantly higher than before Trump’s return to the White House, and the risk of renewed escalation persists.

Economists warn that persistent geopolitical tensions are likely to accelerate trade fragmentation, prompting firms to diversify supply chains and intensify near-shoring strategies. Carsten Brzeski, global head of macro at ING, described the global landscape as one of entrenched uncertainty, noting that trade frictions between the US and China, and increasingly between Europe and China, have become a structural feature of the global economy.

Over the longer term, higher tariffs are expected to suppress trade volumes, increase supply-chain costs, and weigh on global growth.

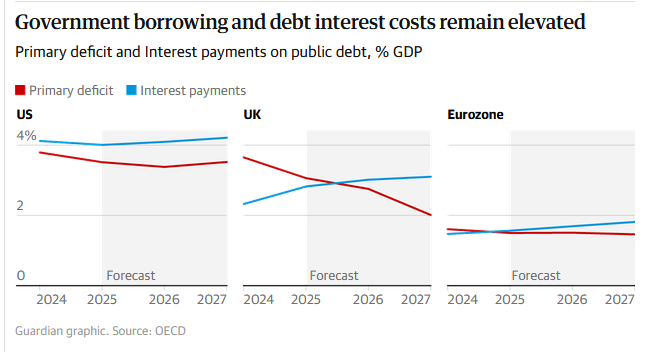

Fiscal pressures and bond market scrutiny

Governments across advanced economies faced mounting pressure in 2025 as borrowing costs rose, particularly in countries burdened by high debt levels and weak growth prospects. Bond market investors—often referred to as “bond vigilantes”—targeted the US, the UK, and France, where fiscal uncertainty unsettled markets.

Despite hopes that easing inflation and stabilising trade relations could provide some relief, fiscal vulnerabilities are expected to remain a central concern in 2026. Highly indebted governments, especially those under pressure to boost economic growth while increasing defence spending, are likely to remain under intense scrutiny.

In the UK, Reeves’s decision to preserve additional fiscal headroom may help mitigate the risk of a bond market backlash. However, political uncertainty persists ahead of local elections and questions surrounding the durability of Keir Starmer’s leadership.

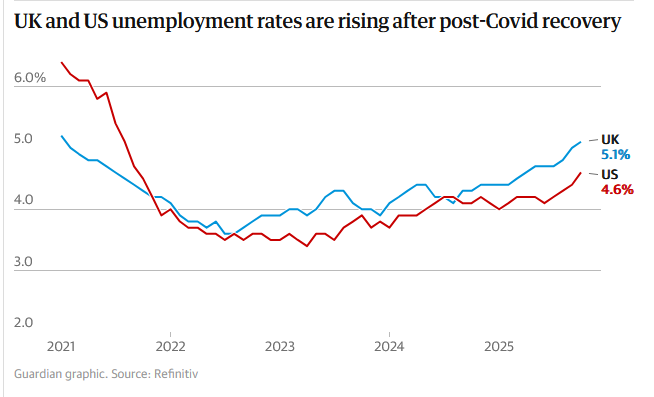

Rising unemployment risks

Against this volatile backdrop, labour markets weakened across advanced economies in 2025. Hiring demand declined sharply, and unemployment rates rose in both the US and the UK, raising concerns about further labour market deterioration in 2026.

Tax policies, business uncertainty, and accelerating AI adoption are expected to exert additional pressure on employment. While there is limited evidence so far of widespread AI-driven job displacement, investment in automation is intensifying. In the UK, rising youth unemployment has become a particular source of political concern, while workforce participation remains constrained by demographic ageing and increasing ill-health.

The UK unemployment rate has already reached 5.1%, its highest level outside the pandemic in nearly a decade, and may climb further in 2026. In the United States, unemployment has risen to 4.6%, a four-year high, prompting renewed questions about the resilience of the world’s largest economy.

Despite these challenges, wage growth is expected to remain relatively robust, helping households rebuild financial buffers. However, persistent wage pressures may complicate the task of central bankers seeking to contain inflation.

As Hannah Slaughter, senior economist at the Resolution Foundation, cautioned, the UK is likely to enter 2026 with rising unemployment and renewed pressure on household incomes, underscoring the need for timely and responsive policymaking.

Source: