China VC Funding Up 28.2% in Q1 2024 Despite Global Downturn

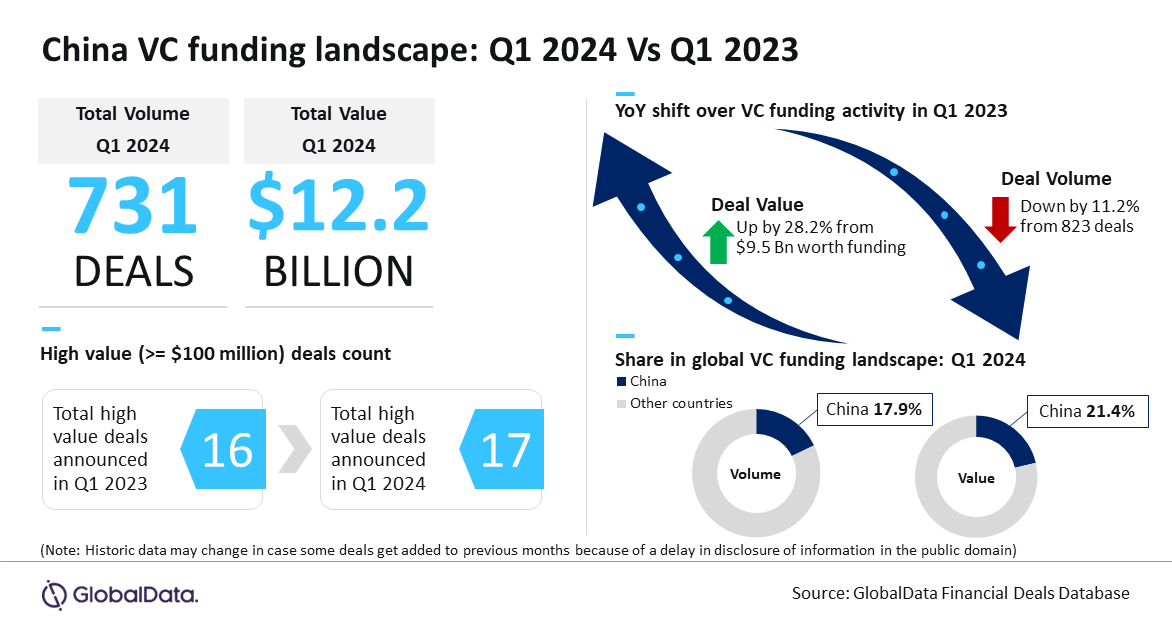

China, the most prolific Asia-Pacific market, witnessed year-on-year (YoY) improvement in venture capital (VC) funding value in the first quarter (Q1) of 2024 despite a decline in deals volume. A total of 731 VC deals worth $12.2 billion were announced in China during the period, which is a 11.2% YoY decline in terms of deal volume but 28.2% YoY growth in terms of value. This trend defied the downturn experienced by many of its counterparts globally, reveals GlobalData a leading data and analytics company.

An analysis of GlobalData’s Deals Database revealed that a total of 823 VC deals were announced in China during Q1 2023 while the disclosed funding value of these deals stood at $9.5 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The improvement in VC funding value becomes all the more relevant when most of its peers, including the US, the UK and India, have registered decline during Q1 2024. China emerged as a notable exception to buck the trend. Moreover, China was the only country to see the announcement of billion-dollar VC funding deals during Q1 2024.”

Some of the notable VC funding deals announced in China during Q1 2024 included $1.5 billion by Changxin Technology Group, $1.1 billion by IM Motors, $1 billion by Moonshot AI, and $933 million by Shanghai Spacecom Satellite Technology.

Bose adds: “Apart from being the top APAC market, China is also a key global market for VC funding activity and stands just next to the US in terms of both VC deals volume and value.”

China accounted 17.9% share of the total number of VC deals announced globally during Q1 2024 while its share of the corresponding disclosed funding value stood at 21.4%.

Note: Historic data may change in case some deals get added to previous months because of a delay in disclosure of information in the public domain.