Notable Green Impact Initiatives Backed By 8 Billionaires During COP28

Forbes Middle East : Eight billionaires—Bernard Arnault & family, Chairman and CEO of LVMH Moët Hennessy Louis Vuitton; Jeff Bezos, Amazon’s founder; Bill Gates, co-chair of the Bill & Melinda Gates Foundation; Steve Ballmer, former Microsoft’s CEO; Michael Bloomberg, CEO of Bloomberg and UN Secretary-General’s Special Envoy for Climate Ambition & Solutions; David Bonderman, Founding Partner, Non-Executive Chair and Director of private equity giant TPG; Bruce Flatt, the CEO of Brookfield; and Larry Fink, the chairman and CEO of BlackRock—announced several green impact initiatives during the COP28.

After intensive discussions for nearly two weeks, COP28 concluded on December 13, 2023. With the total action agenda at COP28, over $85 billion in funding was mobilized, and 11 pledges and declarations were launched and received historic support.

However, the richest 1% of the world’s population produced as much carbon pollution in 2019 as the five billion people who made up the poorest two-thirds of humanity, according to a new Oxfam report in November, putting a huge climate-related responsibility on the shoulders of the world’s billionaires.

Here’s a look at the notable green impact initiatives backed by eight billionaires during COP28. Net worths are as of December 15, 2023, before US market opening.

Bernard Arnault & family

Image by FRANCOIS GUILLOT / AFP

Net worth: $200 billion

Organization: LVMH

LVMH announced a partnership with the Miami Design District to achieve 100% renewable energy in 15 Maisons’ boutiques. The French company stressed that its environmental action has been a pillar of its growth strategy for nearly 30 years.

The group also signed partnerships with several UAE-based real estate developers, including Chalhoub Group, EMAAR Malls Management, Majid Al Futtaim Properties, and Aldar Properties, focusing on eco-friendly practices in shopping malls.

Jeff Bezos

Image by SAUL LOEB / AFP

Net worth: $169.7 billion

Organization: Bezos Earth Fund

On December 1, 2023, at COP28, a new philanthropic investment organization called Allied Climate Partners (ACP) was launched. ACP aims to boost the presence of viable climate-related projects and businesses in emerging economies, to generate substantial environmental, economic, and social benefits.

The initial supporters of ACP include Arnold Ventures, Ballmer Group, Bezos Earth Fund, Anita and Josh Bekenstein, the Children’s Investment Fund Foundation (CIFF), Sea Change Foundation International, the Soros Economic Development Fund (SEDF), Three Cairns Group, and various other contributors.

Bill Gates

Net worth: $117.6 billion

Organization: Bill & Melinda Gates Foundation & TerraPower

The Bill & Melinda Gates Foundation and the UAE committed $200 million to expedite the progress of innovations aimed at assisting smallholder farmers in sub-Saharan Africa and South Asia in building resilience and adapting to climate change.

The foundation’s $100 million investment announced during COP28, which matches the UAE’s commitment of $100 million, will support organizations, like the CGIAR, that are at the forefront of developing agricultural innovations.

Additionally, TerraPower, an American nuclear innovation company founded and chaired by Gates, signed an MoU in advanced nuclear energy with the Emirates Nuclear Energy Corporation (ENEC) during COP28. Gates transformed his wealth from his software firm Microsoft, into a diverse portfolio that includes investments in zero-carbon energy companies.

Steve Ballmer

Image by STEPHANIE KEITH / GETTY IMAGES NORTH AMERICA / Getty Images via AFP

Net worth: $109.8 billion

Organization: Ballmer Group

Ocean Resilience and Climate Alliance (ORCA) has been established by prominent climate and ocean institutions, joining forces to combat climate change through ocean-based solutions. Leading organizations such as Ballmer Group, Bloomberg Philanthropies, Builders Vision, the David and Lucile Packard Foundation, the Gordon and Betty Moore Foundation, the Jeremy and Hannelore Grantham Environmental Trust, Oak Foundation, Oceankind, Paul M. Angell Family Foundation, Rivian Foundation, Rockefeller Brothers Fund, Vere Initiatives, and others have pledged over $250 million to support ORCA’s mission.

Additionally, Ballmer Group-backed ACP, which was launched during COP28. ACP will choose regional investment managers in emerging economies and provide them with de-risking solutions. This will facilitate the rapid increase of climate-related projects and asset-oriented businesses, leading to significant environmental, economic, and social impacts. The model focuses on addressing the financing gap during the early stages of development.

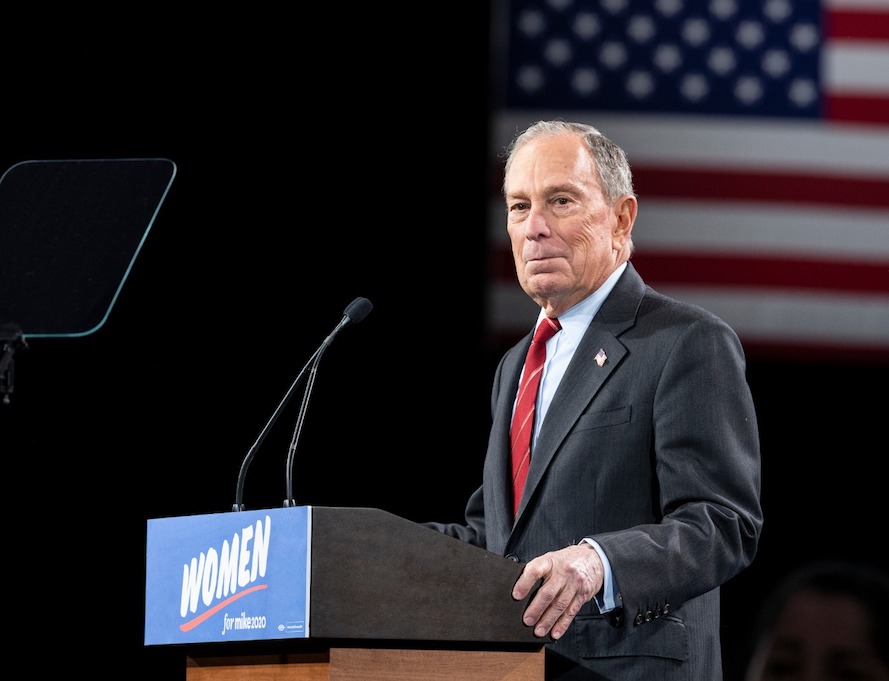

Michael Bloomberg

Image by Lev Radin / shutterstock.com

Net worth: $96.3 billion

Organization: Bloomberg L.P., Bloomberg Philanthropies, & Glasgow Financial Alliance for Net Zero

Bloomberg L.P. supported several environmental initiatives during COP28, including CFLI India’s climate finance solutions with $6.5 billion in potential investments. Ballmer Group, Bloomberg Philanthropies, Builders Vision, the David and Lucile Packard Foundation, and others formed the Ocean Resilience and Climate Alliance (ORCA), pledging over $250 million to support ocean-based solutions in combating climate change.

Bloomberg Philanthropies was also part of a huge effort with the Environmental Defense Fund (EDF), the International Energy Agency (IEA), and others to enhance transparency and accountability in reducing methane emissions from the oil and gas sector. This collaboration is part of Bloomberg Philanthropies’ $40 million commitment to tackle methane emissions. Moreover, Bloomberg Philanthropies co-launched the Industrial Transition Accelerator (ITA) to catalyze decarbonization across heavy-emitting sectors, including energy, industry, and transportation.

Bloomberg also partnered with others to launch the Lowering Organic Waste Methane (LOW-Methane) initiative. Furthermore, Bloomberg announced a new $65 million commitment to continue his longtime support for local climate action and emissions reduction worldwide. Bloomberg Philanthropies, Clean Air Fund, and C40 Cities announced a new cohort of cities to benefit from funding, technical support, air quality data, community engagement, capacity building, and additional support as part of the Breathe Cities clean air initiative. This $30 million initiative was launched earlier in 2023. Bloomberg supported three more initiatives during COP28, including the Net-Zero Data Public Utility, a coal phaseout and clean energy transition with the European Bank for Reconstruction and Development, and the Global Capacity Building Coalition. Glasgow Financial Alliance for Net Zero participated in launching the Global Climate Finance Centre to accelerate climate finance.

David Bonderman

Image by Larry Busacca / GETTY IMAGES NORTH AMERICA / Getty Images via AFP

Net worth: $6.2 billion

Organization: TPG

With a $30 billion boost from the UAE, the world’s largest private climate fund, ALTÉRRA, has found its home in the Abu Dhabi Global Market (ADGM). This historic initiative, launched during COP28, aims to mobilize $250 billion by 2030 to transform emerging economies.

BlackRock, Brookfield, and TPG, with a combined commitment of $6.5 billion, are joining forces with ALTÉRRA to catalyze further investments. India will be the first to see significant projects, while Africa and Latin America are next in line for exploration. Bonderman, co-founder and non-executive chairman of TPG, has met his longtime business partner Jim Coulter while working for billionaire Robert Bass. The duo left the business in 1992 to establish TPG. Bonderman studied Islamic law in Egypt and Tunisia. He also published an article for the Harvard Law Review titled “Modernization and Changing Perceptions of Islamic Law.”

Bruce Flatt

Image by Brookfield

Net worth: $3.5 billion

Organization: Brookfield

Supervising Brookfield, billionaire Flatt backed ALTÉRRA, which has dual engines that drive climate action, including $25 billion for impact investing (acceleration) and $5 billion for risk mitigation in the Global South (transformation). Both components are aligned with COP28’s action agenda.

Flatt, a Canadian national, is renowned as one of the world’s best investors. Following his graduation from college, he began his career at an accounting firm before transitioning to a position at the struggling Canadian company, Brascan. Through a series of astute real estate transactions, he played a pivotal role in revitalizing the company, which ultimately led to his appointment as CEO in 2002. Under his leadership, he transformed the organization into Brookfield Asset Management.

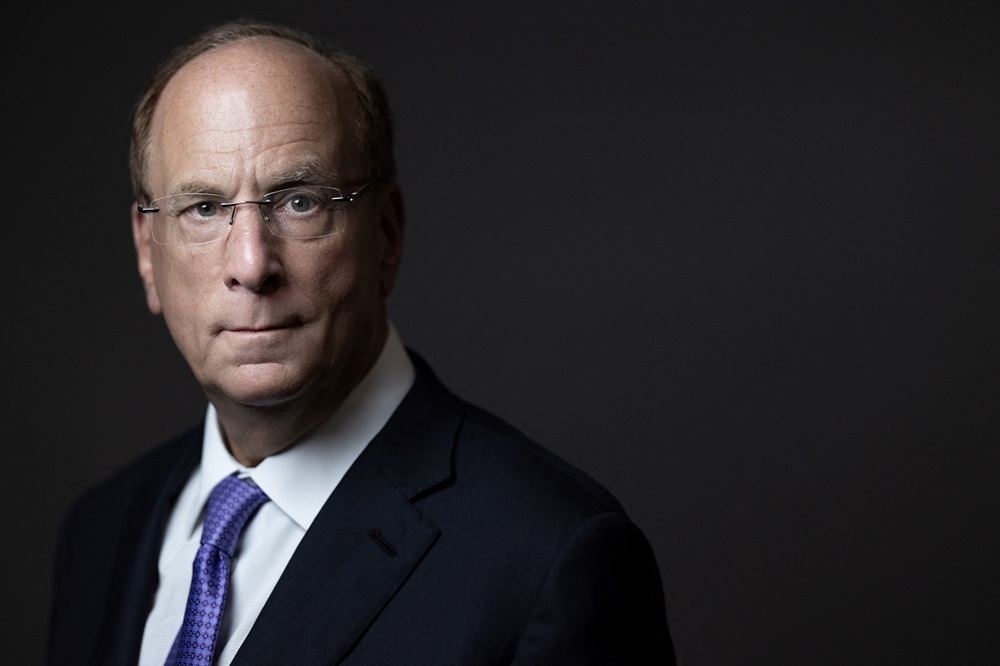

Larry Fink

Image by Joël SAGET / AFP

Net worth: $1.1 billion

Organization: BlackRock

Chairing BlackRock, Fink supports ALTÉRRA. The initiative represents the next step in the UAE’s decades-long journey towards climate action and is dedicated to investing in energy systems. COP28 witnessed the inauguration of the Global Climate Finance Centre in Abu Dhabi to accelerate global climate finance and market design. Nine global founding members confirmed membership, including ADGM, ADQ, BlackRock, CIFF, GFANZ, HSBC, Masdar, Ninety One, and the World Bank Group. Before starting BlackRock in 1988, Fink was a managing director at The First Boston Corporation.