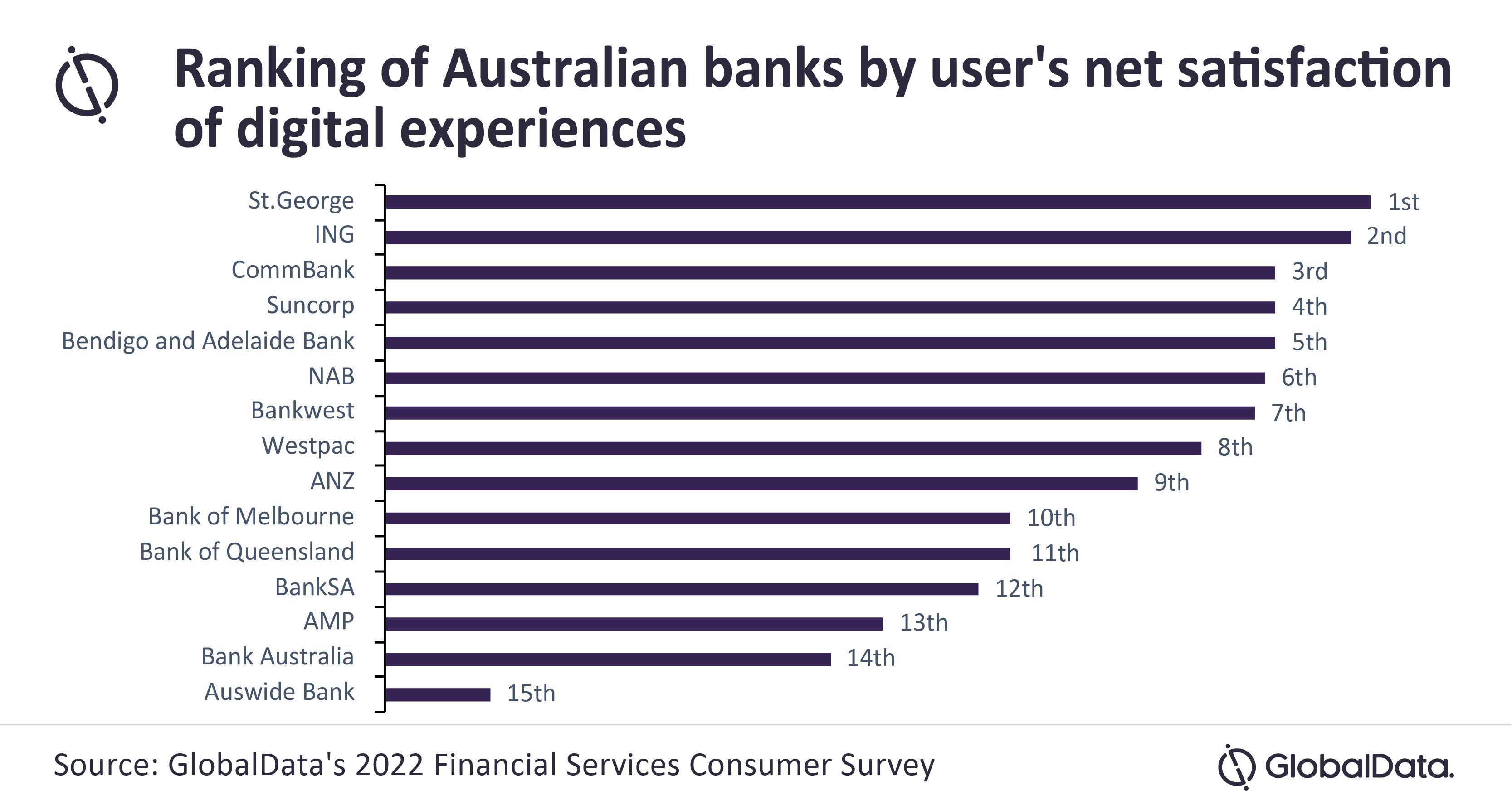

St. George tops list of Australian banks in net satisfaction of digital experience

With digital banking becoming ever prevalent in recent years, banks are scrambling to provide enhanced digital experience to attract and retain customers. Against this backdrop, St. George has emerged as the leading Australian bank for net satisfaction of digital experience in 2022, reveals GlobalData, a leading data and analytics company.

GlobalData’s Australian Competitor Benchmarking report 2022 highlights that there is an 83 percentage points (pp) difference of average net satisfaction score between St. George and the lowest ranked, the Auswide Bank.

The Australian banks received lowest net satisfaction scores for their efforts in helping their customers better use digital banking and understand the range of products offered. Banks in Australia also performed poorly in digital problem resolution where there is lot of variances between all competitors.

Harry Swain, Retail Banking Analyst at GlobalData, comments: “St. George leads the market in all three measured attributes, while NAB scores well in helping their customers in digital banking compared to the other Australian banks. ING provides a good transition between digital channels and outperforms St. George on this metric. Auswide customers have a negative net satisfaction with the range of products their bank offers digitally and is the only bank with a negative net satisfaction score in an attribute.”

The report also notes that with banks encouraging customers to increase their digital channel usage, customers seek support to better understand the features and processes that they use.

Swain explains: “St. George and ING help their customers the most in this area, which enabled to be ranked at the top of the average net satisfaction. NAB that ranks lower overall also performs well in this area, however, the bank needs to improve in other areas where customers find difficulties in order to challenge the other banks at the top of the rankings.”

According to the report, the eight attributes that contribute to the customer digital experience rankings are easy navigation of platform, wide range of products, simple process to access account, appealing branding and features, digital problem resolution, omnichannel, clarity of financial situation, and helping customers better use digital banking.

The net satisfaction of these attributes gives banks a good indication of where they are performing in comparison to their competitors and whether they are meeting the market average.