All posts tagged "prices"

-

1.2KBritain

1.2KBritainU.K. house prices continue to rise at a rapid pace

U.K. house prices continue to rise at a rapid pace British pound is trying to reduce the losses it has suffered since...

-

3.7KInvestment

3.7KInvestmentHow are Investments Affected by High Unemployment Rate?

How are Investments Affected by High Unemployment Rate? The unemployment rate jumped in April 2020 to a level not seen since the...

-

2.0KPalestine

2.0KPalestinePalestine – Decrease in the Producer Price1 Index (PPI) during 2020

Palestinian Central Bureau of Statistics (PCBS) Decrease in the Producer Price1 Index (PPI) during 2020 The overall PPI in Palestine with its...

-

3.0KPalestine

3.0KPalestineThe Performance of the Palestinian economy during 2020, as well as the economic forecasts for the year 2021

The Palestine Monetary Authority and The Palestinian Central Bureau of Statistics The Performance of the Palestinian economy during 2020, as well as...

-

4.7KOil & Gas

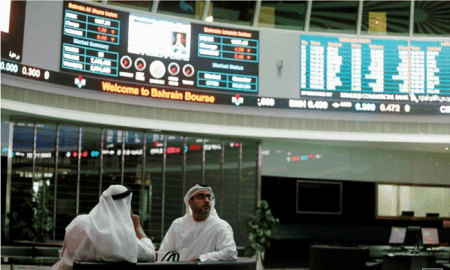

4.7KOil & GasHR units must adapt quickly to stay connected to workforce

Major Middle Eastern markets ended lower on Monday, after oil prices slid on the possible return of Libyan production and as rising...

-

1.6K1Technologies

1.6K1TechnologiesTechnology sector stocks most profitable with 30% average ROI

Technology sector stocks most profitable with 30% average ROI Data gathered by Buyshares.co.uk indicates that the technology sector stocks are most profitable...

-

1.6KSocial Media

1.6KSocial MediaDemand for Wirecard Shares at an All-time High – Growth of up to 284%

Demand for Wirecard Shares at an All-time High – Growth of up to 284% Google searches for “Wirecard stocks” have soared by...

-

1.8KOil & Gas

1.8KOil & GasShareholders prioritized as big oil’s first quarter earnings slump

Shareholders prioritized as big oil’s first quarter earnings slump Earnings of major international oil and gas producing companies have suffered in the...