Jordan: Secrets of a resilient economy

Whenever we think of Jordan, we call to mind the beauty and drama of Petra, the southern seafront city of Aqaba, the amazingly well-preserved ancient city at Jarash, Karak’s marvelous castle, Madaba’s colourful mosaics, and Mount Nebo. Jordanians are well known for their hospitality- not purely for tourists only, but for those in strife or enduring conflict in their homeland. Over the years, the Kingdom has welcomed many in this situation, opening its borders to Palestinians, Syrians and, more recently, Iraqis. So how does this amazing country, without oil reserves and few water resources, have such a resilient economy?

The ongoing Syrian conflict, the new instability in Iraq and the resultant exodus of refugees into neighbouring countries, is far from being over. In Jordan, this is still very much the case. Middle East Business showcased the Lebanese economy in our previous issue and how their economy is adapting to the new geopolitical map.

In this article, we now turn our attention to the effects on Jordan and its economy.

Misfortune for some, fortunes for others?

When meandering through the modern quarters of its capital city, Amman, one can hear an abundance of Arabic dialects. How does Jordan cope with such an influx of newcomers?

Due to the ongoing political instability in neighbouring Syria, and more recently Iraq, the regular arrival of refugees and subsequent re-routing of regional tourism towards the notably stable Hashemite Kingdom of Jordan, has contributed to increased domestic demand. It has given a welcome boost to the recovery of the tourism sector and helped improve growth in related services such as hotels, furnished apartments, car rental and even real estate.

The great challenge … jobs for all

According to the World Bank’s economic report, the arrival of so many Syrian refugees has negatively affected employment opportunities in the Jordanian informal sector.

The unemployment rate declined slightly from 12.9% in 2011 to 12.2% in 2012. At first sight, we might think that there will be more competition for jobs, but it seems that it’s unlikely that Syrians will enter the public sector or the formal private sector, both of which are difficult for Syrian refugees to access for legal reasons.

However, competition for jobs with Jordanians is more apparent in the informal sector.

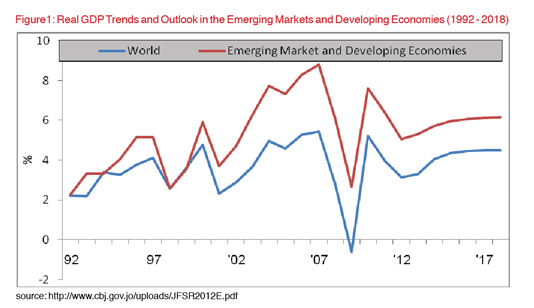

Globally, emerging markets and developing economies continue to grow faster than developed economies. However, 2013 indicators signaled a slowdown in the economic growth of these countries, whilst in the developed economies there appeared to be a growing difference. (figure1)

Jordan‘s economic performance 2013

Jordan, population 6,318,000, is still adjusting to its own political situation and the unstable regional security, particularly in its neighbouring countries. There have been negative repercussions on the performance of the national economy as a result of hosting large numbers of refugees and the resulting pressure upon basic resources, especially in the areas of energy and water.

Against all odds

In terms of working environment, the Global Competitiveness Report 2013 – 2014 has shown that Jordan has a positive ranking in the major indexes and many of the sub-indices, including:

Major index rankings

76 on the Key Requirements Index

70 on the Enhancement of Efficiency Index

51 on the Innovation and Creativity Index

Sub-indices

- Grade 7 in the Index the availability of scientists and engineers

- 13 on the Absence of Organised Crime Index

- 27 on the Index of Adaptation of Institutions to Technology

- 34 on the Ease of Access to Finance Index

- 38 on the Index of Quality Infrastructure

- 44 on the Quality of Education Index

- 48 on the Index of Judicial Independence

Ease of “Doing Business“ in Jordan

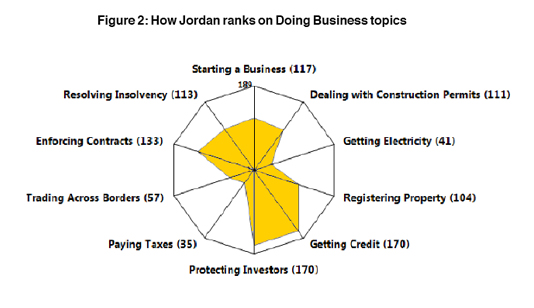

For the past two years, Jordan stood at 119th out of 189 countries on the World Bank’s “Ease of Doing Business” study. The study sheds light on how easy or difficult it can be for a local entrepreneur to open and run a small-to-medium sized business when complying with relevant regulations. It measures and tracks changes in regulations affecting 11 areas in the lifecycle of a business: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting investors, paying taxes, trading across borders, enforcing contracts, resolving insolvency, and employing workers. (see figure 2)

Economic growth

In 2013, the Jordanian economy was able to overcome the effects of the Syrian crisis to some extent as a result of several reasons, including the recovery of public investments funded by grants from the Gulf Cooperation Council (GCC).The Jordanian economy has recorded real economic growth amounting to 2.8% during the first nine months of 2013, compared to the corresponding period of 2012, bringing the size of Gross Domestic Product (GDP) at constant prices to 8.1 billion dinars ($11.4 billion).

Inflation

Reducing government subsidies for electricity and oil and rising prices for food (with the increased demand from Syrian refugees) directly impacted upon the overall rate of prices in the Kingdom. The rate of inflation during 2013 (as measured by the change in the average index of consumer prices) grew by 5.6%, compared with 4.7% in 2012.

Public Finance

Jordan witnessed several developments in the field of public finance during the first eleven months of 2013, compared to the corresponding period in 2012.

Here are three of the most important of these developments:

Public Revenues – rose by 13.2% during the first eleven months of 2013 to reach 5.1 billion dinars. This increase came as a result of increased foreign aid by 500% to 579 million dinars, and an increase in local revenues by 2.6% to 4.5 billion dinars.

External competitiveness – remains quite stable, although the nominal value of exports in 2013 might not show real growth. However, this reflects the slowdown in global growth/trade rather than domestic factors. International oil prices for crude oil and petroleum products account for 26% of the total import bill, which impacts significantly upon Jordan’s external accounts.

Foreign Trade – total exports rose during 2013 by 0.3% to about 5.6 billion dinars (812 million dinars including re-exports). Total imports rose by 5.4% to about 15.5 billion dinars.

Moving to a knowledge-based economy

Ten years back, Jordan took its first steps toward building a knowledge-based economy. A national agenda was prepared at that time and a three-step road map created:

From the year 2004 to 2009, improvements to fundamentals in education (where Jordan enjoys high literacy rates), the business environment, and other areas;

From 2009 to 2015, development of a competitive manufacturing base; and

After 2015, the knowledge-based economy will start to grow and develop.

Various factors interfered with the achievement of these plans, most significantly being the difficult geopolitical environment in which the country has found itself.

Jordan‘s banking sector

Jordan has a safe and sound banking sector able to withstand a fair amount of turbulence as a result of high levels of capital held by the Jordanian banks. Capital is the highest in the Middle East as well as having comfortable levels of liquidity as stated in the Financial Stability Report for 2012 issued by Jordan’s Central Bank.

Jordan’s banking sector consists of 26 banks, including 13 Jordanian commercial banks, 9 Arab and foreign commercial banks, 3 Jordanian Islamic banks and one Arab Islamic bank.

The number of branches of banks operating in the Kingdom at the end of the year 2013 reached 739 branches compared with 714 branches at the end of 2012 with the opening of 20 new branches in different cities of the Kingdom.

However, the government has initiated a series of interventions to improve the business climate. A committee to accelerate improvements to the business environment has been put in place. Wide-ranging legislative changes and reforms of financial infrastructure have also been initiated in order to broaden access to financial services. A particular priority is widening access by small and medium- sized enterprises to financing.

More broadly, new laws and institutions have been established to enhance the transparency and accountability of state institutions. However, the limited capacity of the implementing institutions is a major issue, one that has become a focus of government attention.

*1USD = JD 0.71

Sources:

Jordan Central bank

Jordan Statistics Bureau

International Monetary Fund – IMF

World Bank – Jordan Economic Monitor

Euler Hermes SA

Iskan Bank publications.